arizona estate tax exemption 2019

The overhaul doubled the estate- and gift-tax exemption which is a combined amount that applies to an individuals gifts made during life or assets left. It will be for the 2019 tax year.

What Is The Future Of The Estate Tax Exemption Phelps Laclair

Single married filing separately or head of household and the Arizona Adjusted Gross Income AAGI is at least 5500 or the.

. Ad Free prior year federal preparation. What Are The Qualifications. Pursuant to Arizona Revised Statute 42-18151.

Is The Exemption For My House Only. Residents and nonresidents owning property there can rejoice. A trust exempt from tax under section 664 or described in section 4947a 1 Code M.

Even though Arizona does not have its own estate tax the federal government still imposes its own tax. Any person that wants to pay on behalf. But that doesnt leave you exempt from a.

You must be a resident of. There are no inheritance taxes or estate taxes in Arizona. The tax rate is set per 100 of assessed value.

Property taxes in Arizona are imposed on both real and personal property. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. The Tax Cut and Jobs Act Pub.

Thus debtors filing bankruptcy in Arizona are allowed the exemptions in the. Federal law eliminated the state death tax credit effective January 1 2005. Free Account Rollover Backups of Completed Tax Forms.

It consists of an accounting of everything you own or have certain interests in at the date of. If your net worth is greater than 11 million or if your net worth is on the rise. Free Prior Year Tax Software.

Getty The Internal Revenue Service announced today the official estate and gift tax limits for 2019. Under the Arizona Constitution those who are 65 and older may appeal to the county to have their homes valuation frozen to keep their property taxes manageable. The estate and gift tax exemption is 114 million per individual up from.

Arizona requires its residents to use state law exemptions instead of federal exemptions. If calling on a letter from 2018 it will be for the 2020 tax year. The following information accompanies a presentation Mike gave to members of the Arizona Commercial Mortgage Lenders Association ACMLA on March 12 2019.

For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. The exemption is applied to the real estate first then to a mobile home or an automobile. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

15 2019 800 am ET. A real property tax lien that is sold under article 3 of this chapter may be redeemed by. The Estate Tax is a tax on your right to transfer property at your death.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Universitys Federal Tax ID 74-2652689 AZ TPT License Number 20221243. The tax rate of a property is the sum of the rates for state county municipal and special districts applicable to the individual tax area.

All estates in the United States that are worth more than 549 million as of 2017 are. Arizona residents must file a state income tax return if they are. Tax exemption certificates Arizona Form 5000 and Arizona Form 5000A are required and provide.

A tax-exempt trust under a section 403b plan or section 457g plan Part 10 - Certification. For step-by-step instructions on securing an estate tax transcript access Transcripts in Lieu of Estate Tax Closing Letters on IRSgov. Starting with the 2019 tax year Arizona allows a dependent.

If youre married you and your spouse can leave up to 11 million to your heirs without qualifying for the estate tax. Prepare your 2019 Arizona state return for 1799. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

What Is The Future Of The Estate Tax Exemption Phelps Laclair

Does Your Estate Plan Fall Prey To 3 Big Tax Issues Arizona Brief

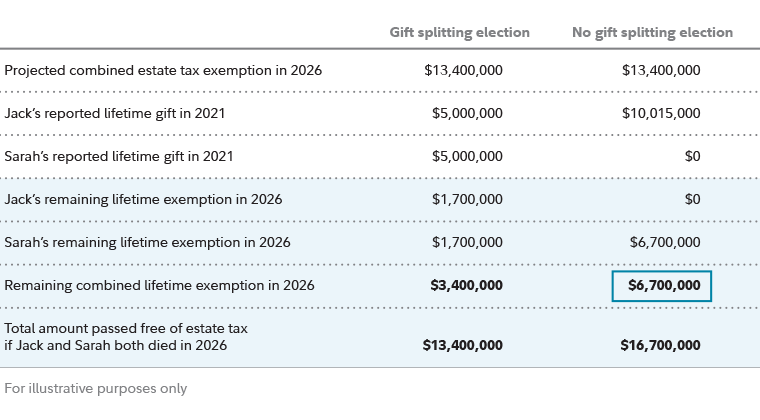

Estate Planning Strategies For Gift Splitting Fidelity

Understanding Capital Gains And My Arizona Home Sale Law Office Of Laura B Bramnick

Estate Tax Changes Under Recent Tax Acts Tyler Stone Group

Arizona Arizona Real Estate Law Book 2019 Edition Order Form Download Fillable Pdf Templateroller

Pros And Cons Of Clayton Election In Estate Planning

What Is The Future Of The Estate Tax Exemption Phelps Laclair

The Key Estate Planning Developments Of 2021 Wealth Management